They Said it Couldn’t Be Done!

Many in Academia Claim It’s Not Possible to Beat the Market…

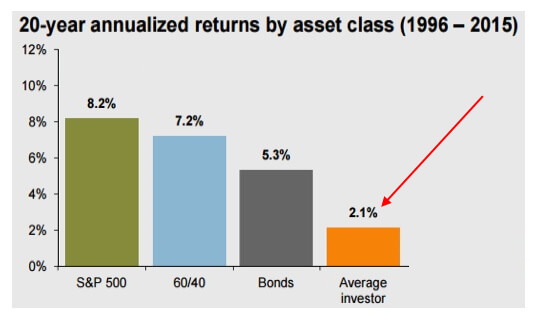

Factors such as the Efficient Market Hypothesis, the lack of consistent yearly returns for most stock traders, as well as dismal returns from Hedge Funds – all add credit to this claim. I mean, just look at the average investor performance over a 20 year period versus the S&P 500.

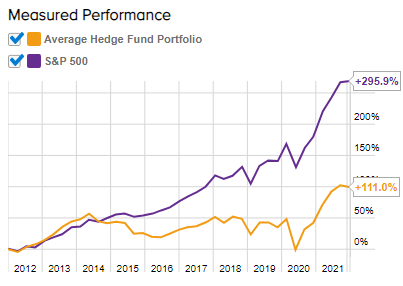

And if you think the Hedge Funds did better – then you’re mistaken. Here are the average returns for Hedge Funds vs. the S&P 500 from the last 10 years…

Picking individual stocks is extremely difficult, not just for the average investor, but even for the best and brightest in the industry. But what stands out is the S&P 500 – a benchmark that few, if any, can beat over an extended period of time.

Why is it that the S&P 500 – the top 500 companies in America – always end up winning? And what makes these companies so special? Why is it that so many regulars traders, as well as market “experts,” fail to beat this index every year?

A New Study Emerges…

Around three decades ago, a unique investment strategy was laid-out in a research paper which is unknown to many traders today. The authors of the study, who we’ll call Mike and Jim, focused on a 25 year time-period to backtest their newfound hypothesis. And the results… the strategy was able to beat the market!

These authors obtained returns which, over this long of a time-period, had not been achieved in financial history. Returns which would make even the most accomplished hedge funds drool with envy. You may be thinking, this is only 25 years… maybe they just picked a beneficial period of time and got lucky… or maybe not.

Intrigued by this study, many researchers began trying to replicate it… and the results were astonishing! Not only was the study replicable in the United States, but also in international markets and even across asset classes. And these new researchers didn’t stop at 25 years, but instead backtested almost 100 years of data… with the same results! Today there are dozens of studies from multiple authors, all published in the top financial journals, which have replicated the same results from Mike and Jim’s original research paper.

What’s amazing about the strategy Mike and Jim discovered was they didn’t pick stocks in a “normal” fashion, using failed techniques such as fundamental or technical analysis – techniques which many stock investors and hedge fund managers still use today. Instead the stocks were essentially picked for them with the equations they developed!

Why Haven’t More People Heard of This?

That is a great question. The best answer I can give you is it’s not “sexy” enough. The strategy allows you to consistently beat the S&P 500 by about 3% a year. But if you’ve ever performed an internet search on trading stocks, you’re well aware most traders want to learn how to be rich right now! They want 100% returns every month and to be able to quit their job yesterday.

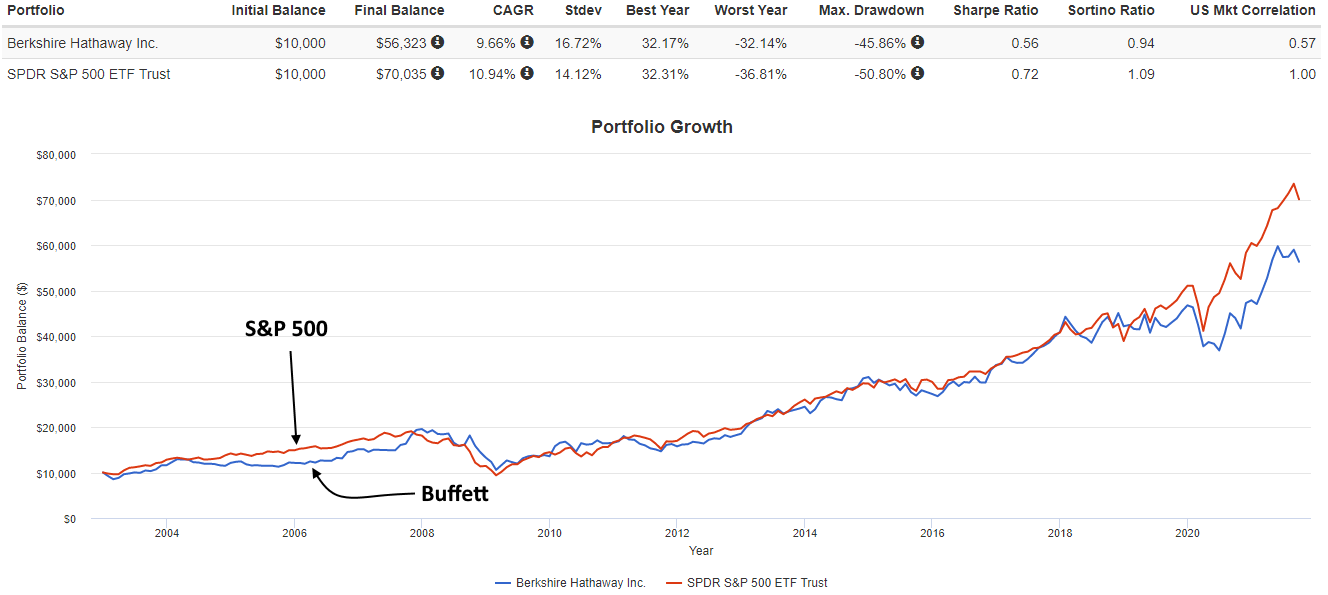

And then try typing in “top stock trader” on Google, and results like Warren Buffett and Bill Miller will fill your screen. These would be traders who used fundamental analysis, a flawed strategy which many hedge funds still use today. I say “flawed strategy” because fundamental analysis is considered an art. Millions of people try to use it – most fail – and very few are able to use it successfully. And even for the traders who do use it successfully, their “skills” tends to diminish with time. I mean, take a look at Buffett’s returns since 2003 versus the S&P 500.

Not even the “greatest” value investor has been able to beat the S&P 500 over the last 20 years. The S&P 500 is the ultimate benchmark, and most traders would do quite well just keeping this index in their portfolio. I keep bringing up the S&P 500, because the fundamentals behind this index are why Mike and Jim’s strategy worked so well. You could say Mike and Jim’s discovered a way to supercharge the S&P 500.

Is There Extra Risk?

No… none. We are not using options, leverage, loans, etc. to achieve the excess returns I present this book. It is purely buying regular old stocks. But what makes this strategy different from other stock picking techniques you may be aware of (e.g. fundamental analysis) is the strategy is a science… not an art. Meaning you don’t need to know the perfect way to draw squiggly lines on a chart, or how to flawlessly dissect a balance sheet, in order to pick stocks. The math, relayed in all the studies I present, shows you exactly what stocks to choose. Meaning anyone who uses this strategy will achieve the same results – compare that to value investing or technical analysis.

It Gets Even Better Though

That math part I just mentioned, which allows you to decide what stocks to pick, companies do this for you (at no cost). Meaning all the hard work is taken care of. And with the strategy I provide in the book, very little capital gains tax needs to be paid each year, potentially even none, making this the ultimate buy-and-hold, long term stock strategy… just what the doctor ordered!

Tim… This Seems Too Good to be True

I know, I know. I was dumbfounded myself when I first discovered this all. But after reading the many research papers written about this subject, I couldn’t argue with the results. So I tried it, and what do you know… it worked! I think it is an absolutely fabulous strategy, but as famous analyst Nassim Taleb once said,

“Don’t tell me what you think… tell me what you have in your portfolio!”

The strategy I will present to you in this book (as well as a smaller allocation placed into the The 20% Solution), is what I currently implement in ALL of my long-term portfolio. It works, and if it didn’t work, I wouldn’t be telling you about it.

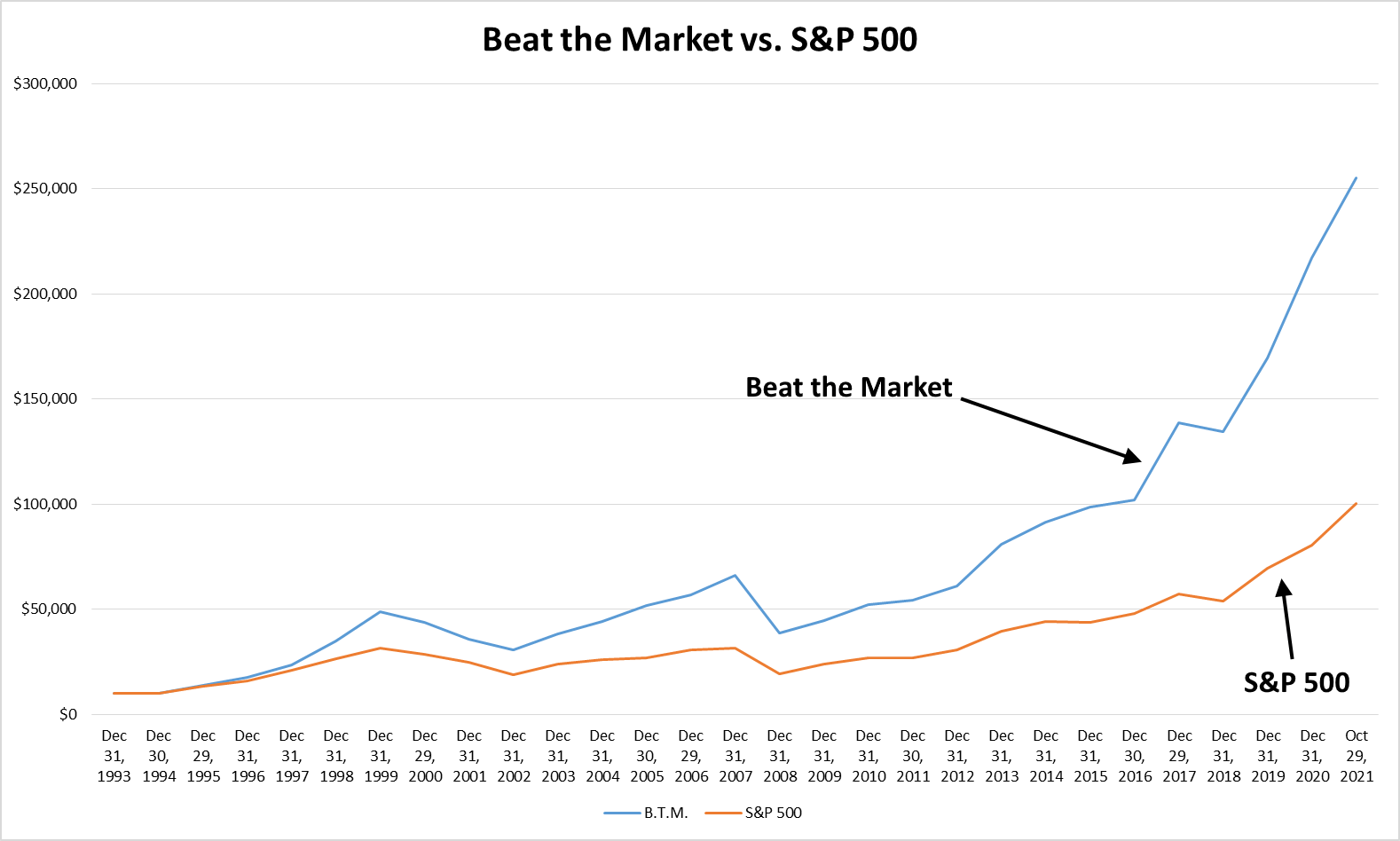

Let me show you how investing $10,000 in 1994 with this strategy, versus the S&P 500, would have fared today…

Can’t really argue with that chart. Since 1994, this strategy has beaten the S&P 500 by an average of 3.12% per year. And with the power of compounding interest, it was able to achieve a final value 2.54x higher than the S&P 500 when all was said and done.

Here are Some Facts to Consider:

- No Excess Risk – Regular stocks are used; no options, leverage, etc.

- Comparable Volatility – B.T.M. has essentially the same volatility as the S&P 500.

- Science – This strategy is a science… not an art, meaning everyone who uses it achieves the same results. Not only that, all the leg-work is taken care of for you, and at no cost.

- Higher Sharpe Ratio – Since 1994, this strategy has achieved a Sharpe Ratio of 0.75, versus just 0.61 for the S&P 500. Meaning, weighing risk vs. reward, B.T.M. is a better overall strategy than even the best market index!

- Rebalancing Just 4 Times a Year – You will only touch your portfolio four times a year, with very little going to capital gains tax, or even potentially none.

- Excess Gains – The strategy has been able to beat the market by an average of 3.12% over the last 27 years, with similar returns dating back almost 100 years!

- All Sources Included – Referenced inside this book are all studies and sources, meaning you can get the facts straight from the horse’s mouth (should you seek additional reference).

Don’t Pass Up this Opportunity!

Sure, you could just invest in the S&P 500 and beat most other traders… but why not do better? The strategy I lay out for you in this book allows you to beat the S&P 500. Couple that with a higher Sharpe Ratio, zero excess risk, and comparable volatility, and it really becomes a no-brainer.

So what are you waiting for? Pick up your copy of How to Beat the Market right now!

Read on your Kindle, smartphone, or computer.

Normally $69.99

SALE: Only $39.99