How Does 20.13% a Year in Returns Sound to You?

You probably think I’m crazy right? Or selling a Bernie Madoff style ponzi scheme? I’d probably think the same thing if I were you. But stay with me, as I’m about to explain why it’s not only possible, but can be accomplished with less volatility than investing in the S&P 500.

Let’s start with how you’re “supposed” to invest. You find a few stocks that you hope will perform well in the future. You do some fundamental analysis, maybe draw some squiggly lines on a chart, and then you purchase them. Some time goes by… and the stocks haven’t moved much. You start thinking to yourself:

- Do I sell?

- Maybe I’ll move my money into different stocks?

- Should I just wait it out?

Then you start checking your stock account everyday, wondering if your portfolio will go up or down. Your whole day starts revolving around checking your stocks, trying to anticipate the future. Will they go back up? Will I lose money?

It Doesn’t Have to Be This Way!

People look at stocks like Amazon and see the enormous gains since it went public. They think to themselves “If I would have just bought it then, I would be rich!” This is easy to say in hindsight. There were literally hundreds of “Amazon” type companies at the time, many of which have gone out of business! Most people are not psychics. They don’t know which stocks will do well and which will be losers. Even the best fundamental and technical analysis is often wrong. A lot of the stock market is random! As I explain in my free guide Crush the Market, most money managers (upwards of 95%) don’t beat the market. These are the best and brightest financial professionals at banks, hedge funds, and other large institutions. So if these Harvard graduates can’t pick stocks that will beat the annual return of the S&P 500, what is the average trader to do?

The Market is Your Friend

Trying to pick individuals stocks in an effort to beat the market is not an efficient strategy. A better idea is to use the known gains of the general market as your backbone. You see, since the inception of the S&P 500 in the early 1900’s, the average return has been 9.80% a year. In other words, if you were to just place your money into the S&P 500 without touching it, you would average 9.80% annually (over a long-term time horizon). Now this is of course an option, but unfortunately investing all of your portfolio into stocks means dealing with a lot of volatility. Some years you might make 18%, other years 1%, and other years you’ll make negative returns. What if there was a way to not only make larger returns than the general market, but also reduce some of the volatility that goes along with it?

There Is a Solution

The strategy I reveal to you in this book takes care of all the leg work for you. This is a buy-and-hold strategy. You don’t have to “pick” stocks in an effort to beat the market… the stocks are already picked for you. Capital gains taxes? There are almost none, as you’re rebalancing your portfolio just 4 times a year. Volatility and drawdowns? Both are lower than the S&P 500. You are getting your cake… and eating it too. A strategy which doubles the gains of the S&P 500, with less volatility and drawdowns.

What Kind of Data Backs This Up?

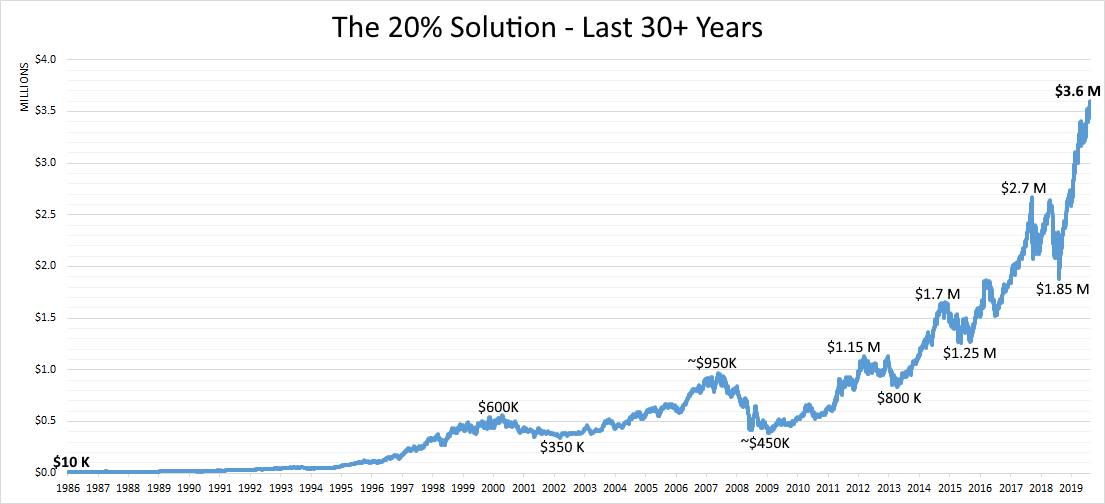

Taking into account over 30 years of data going back to the 1980’s, which includes the many market corrections, crashes, and economic events which precipitated the time period, this strategy has averaged a 20.13% annual return. But some years, it has been much higher! For example, in 2019 this strategy achieved a 63.59% return, and in 2020 it gained even more, ending the year with a 67.04% return. Factor in compounding interest and you can easily see how profitable this strategy can be over time.

I want to show you what using this strategy would look like in your portfolio. The chart below starts with a balance of $10,000, adding absolutely nothing to it, and documents the growth of The 20% Solution over the last 30+ years (until 2019).

This was only $10,000! Now imagine the gains you could achieve adding just a small portion of your paycheck each month to the strategy… you’re talking about enormous returns!

But Wait! What About the Risks Tim?

Good question. Every stock strategy will have both good years and bad. But what matters is how good those bad years are. Let’s compare how this strategy held up versus the S&P 500 during the crashes of 2008 and 2020.

| xxx | S&P 500 | 20% Solution | Event |

|---|---|---|---|

| Max Drawdown | -55.23% | -43.08% | Financial Crisis (’08) |

| Max Drawdown | -19.43% | -15.31% | Covid Crash (’20) |

As you can see from the table, while all portfolios fell during these crashes, The 20% Solution was less volatile than the S&P 500, while averaging more than double in yearly returns. Considering this strategy has less drawdowns and less volatility than the S&P 500, one could argue it’s actually less risky! And as stated before, this is buy-and-hold. You are not glued to your phone all day trading stocks, but instead just have to rebalance 4 times a year. And rebalancing encompasses just a small fraction of your portfolio, meaning very little is destined to capital gains tax. In other words, you get keep more of your hard earned money!

What’s Included in the 3rd Edition?

- A detailed explanation of the types of assets you’ll be investing in.

- How this strategy is able to achieve such extradordinary gains, while at the same time, limiting volatility.

- The complete 20% Solution strategy backed-up with charts, statistics, and 33 years of data!

- *New Chapter: Future of the Strategy* – Learn why this strategy has delivered so well in the past, works now in the present, and will continue to deliver far into the future!

- Have questions? The last chapter lists the most commonly asked questions related to this strategy, with detailed answers explaining each one.

- Still got questions? I include my personal e-mail address at the end of the book. Reach out to me anytime!

What Are You Waiting For?

Stop worrying about picking stocks and dealing with lousy returns! This buy-and-hold strategy takes care of everything for you, while making you over 20% a year. Do yourself a favor and pick up a copy of The 20% Solution right now!

This book is a PDF which can be read on your Kindle, smartphone, or computer.

Full Book Value: $300

PRICE: Only $39.99